Featured

Tax On 12000

We have updated our calculator to include the changes for 2020. And there is a max 10000 limit 5000 MFS of property tax and state taxes SALT.

China S New Individual Income Tax Law Lehmanbrown Comments Lehmanbrown

China S New Individual Income Tax Law Lehmanbrown Comments Lehmanbrown

As your total yearly earnings of 12000 are below this personal allowance you will pay no tax on your income.

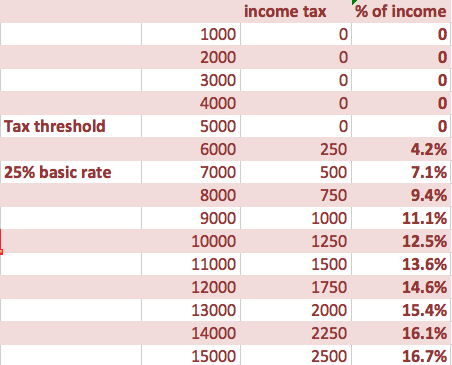

Tax on 12000. Now find the tax value by multiplying tax rate by the before tax price. Earning Bracket Tax Rate x Taxable Earnings This Bracket Tax Due. This is mostly done to account for inflation.

The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance. Firstly divide the tax rate by 100. Line 12000 was line 120 before tax year 2019.

This tax exemption will not be available in case you are opting for the new tax regime. The table below illustrates how to calculate income tax on a 1200000 salary in Australia. You will pay 2318 in North Dakota State tax on a 1200000 salary in 2021.

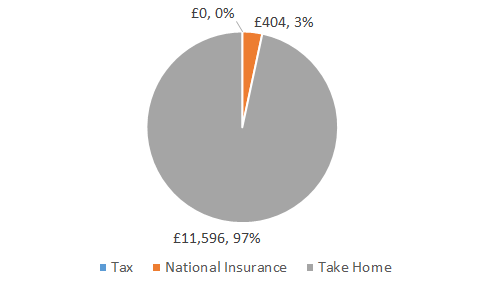

This is a break-down of how your after tax take-home pay is calculated on your 12000 yearly income. If you earn 12000 a year then after your taxes and national insurance you will take home 11700 a year or 975 per month as a net salary. The changes to the tax withholding schedules announced in the Federal Budget 202021 are not reflected in this calculator as the 202021 calculator wont be available until 1 July 2021.

Get savvy with your income tax Work out your monthly take-home pay. That means for Single the first 12000 of income is not taxed or tax free. This equates to 97568 per month and 22516 per week.

Further budget 2018 also introduced the concept of standard deduction of INR 40000 which has been again increased in budget 2019 to Rs 50000. 1200000 180000. First the taxable income is calculated this is then used to calculate the amount of personal income tax due.

Federal Tax Calculation 2021. There are different tax rules for Scotland. It can be used for the 201314 to 201920 income years.

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. This year the Standard Deduction will be doubling so many people will be switching to the Standard Deduction. What is the tax on it and what is the total price including tax.

Income Tax Act provides various exemptions from salary like house rent allowance leave travel allowance etc. This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan payment. Based on a 40 hours work-week your hourly rate will be 563 with your 12000 salary.

The threshold for your filing status is 250000 which means you dont owe the NIIT solely based on that income. Review this tax guide for a full breakdown of how to calculate your income tax and prepare your tax return. Lets take a look at how we calculated these income tax deductions in more detail.

Canadian-source dividends are profits you receive from your share of the ownership in a corporation. To easily divide by 100 just move the decimal point two spaces to the left. This income tax calculation for an individual earning a 1200000 salary per year.

This change is reflected in your taxable income. SARS Income Tax Calculator for 2022 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. If you work 5 days per week this is 4503 per day or 563 per hour at 40 hours per week.

Use this Tax Calculator to get an estimate of the amount of money you owe in federal taxes for 2020. By admin on 3 July 2019 For the 2019 2020 tax year 12000 after tax is 11596 annually and makes 966 net monthly salary. 1200000 After Tax.

Tax 1200 0075. Every year the IRS changes the way your tax is calculated. How did we calculate North Dakota State Tax paid on 1200000.

If you earn 12000 in a year you will take home 11700 leaving you with a net income of 975 every month. On a 12000 salary your take home pay will be 1170816 after tax and National Insurance. However even if you pay no tax you might still have to pay National Insurance on some part of your 12000 income.

- Taxable amount of dividends eligible and other than eligible from taxable Canadian corporations. Use our free online SARS income tax calculator to work out how much your monthly salary will be taxed for in 202122 based on the South African budget. This figure is for guidance only and does not in any way constitute financial advice.

However you also have 75000 in net investment income from capital gains rental income and dividends which pushes your total income to 275000. 75100 0075 tax rate as a decimal.

12 000 A Month After Tax Us May 2021 Incomeaftertax Com

12 000 A Month After Tax Us May 2021 Incomeaftertax Com

Progressive Tax Economics Help

Progressive Tax Economics Help

12 000 After Tax After Tax Calculator 2019

12 000 After Tax After Tax Calculator 2019

Make 12k A Year Tax Free The Times

Make 12k A Year Tax Free The Times

Global Evidence On Effective Design Of Tax Incentives

Global Evidence On Effective Design Of Tax Incentives

Https Pmr Uni Pannon Hu Articles 6 1 2 Papp Molnarne Barna Gyuracz Nemeth

How To Calculate Income Tax From Salary Walletfunda

How To Calculate Income Tax From Salary Walletfunda

12 000 After Tax 2021 Income Tax Uk

12 000 After Tax 2021 Income Tax Uk

12 000 After Tax Uk Income Tax Calculator

12 000 After Tax Uk Income Tax Calculator

Accounting For Income Taxes Ppt Download

Accounting For Income Taxes Ppt Download

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Foreigner S Income Tax In China China Admissions

/dotdash_Final_Net_of_Tax_Dec_2020-01-6a4fe74694524bc2b0172845c7c8068c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Net_of_Tax_Dec_2020-01-6a4fe74694524bc2b0172845c7c8068c.jpg)

Comments

Post a Comment