Featured

Push Payment Fraud

Whilst the majority of scams were perpetrated against individuals of that sum 126m was stolen from UK businesses. Reimbursement for authorised push payment fraud.

Authorized Push Payment Fraud Help Protect Your Customers

This kind of fraud can affect any property purchase whether by an individual or a.

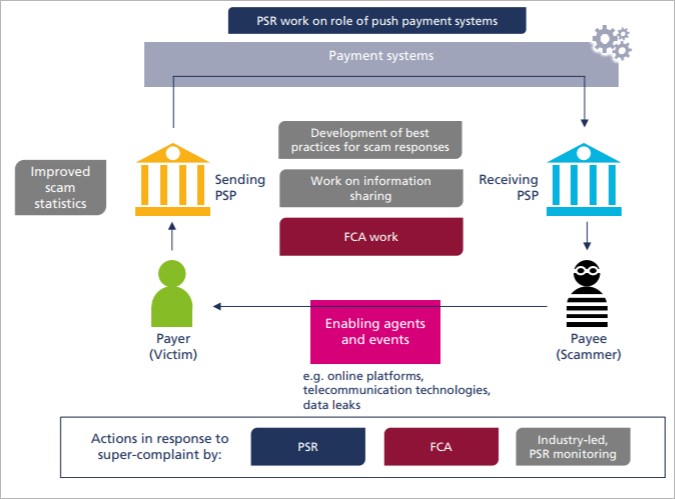

Push payment fraud. The Financial Conduct Authority FCA has today published new rules allowing victims of Authorised Push Payment APP fraud to complain to the payment services provider PSP receiving their payment. For example a scammer pretends to be from your banks fraud team and warns that you need to move your money to a safe account but its actually an account the fraudster controls. Fraudsters gain access to an individuals information usually via a hacked email account and then present themselves as a company with whom the hacked account owner is already doing business.

It started with a phone call to their home landline and ended with a police stakeout and panic alarm being fitted in their Cambridgeshire home. What Is Authorised Push Payment Fraud. Authorised push payment APP fraud occurs when a customer is duped into authorising a payment to another account which is controlled by a criminal.

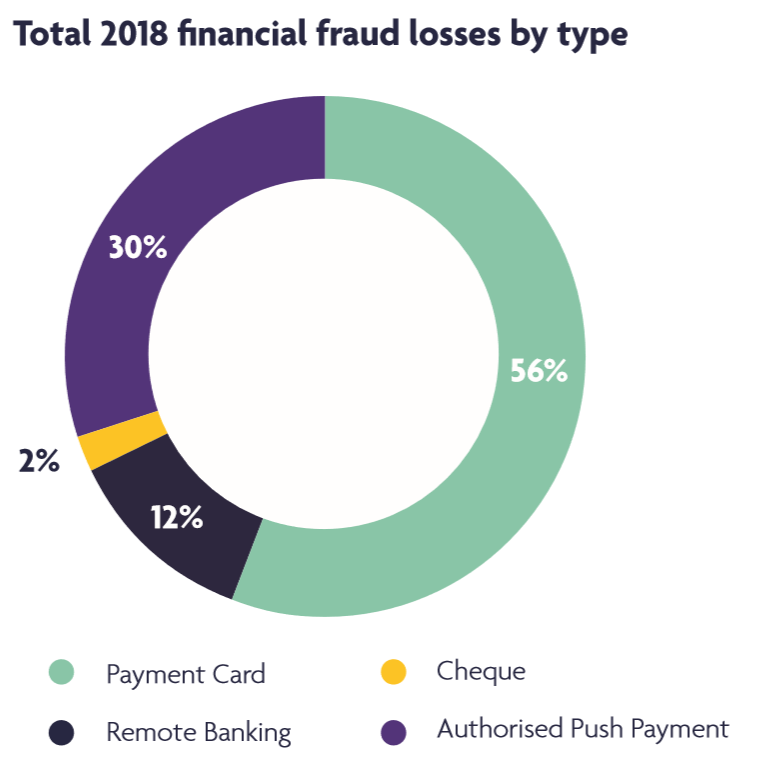

The money is then quickly transferred to different accounts often abroad which makes getting it back almost impossible. A total of 208 million was lost to APP fraud split between personal 147 million and business 61 million accounts. A push payment fraud will therefore involve the fraudster somehow persuading the victim to organise a transfer to the fraudsters account.

Push payment fraud also called APP fraud happens when cybercriminals deceive individuals into sending them money. A retired couple who lost 43000 to. When successful an accountholder is deceived into thinking they have transferred funds to a legitimate payee such as a trade supplier but in actual fact the destination account is controlled by a fraudster.

What is Push Payment Fraud. Essentially this is when scammers convince a customer to transfer money to them via an instant payment. Examples could include a fraudster who poses as a solicitor and asks the victim to deposit monies for a property transaction a fraudster who poses as a builder to receive a large cash transfer or a fraudster who impersonates a victims friend in order to persuade them to.

Just over a year since the launch of the UKs first set of standards detailing how to treat victims of authorised push payment APP or bank transfer fraud we outline consumers experiences and make recommendations as to how to improve the system further. In APP Fraud the payment is being authorized and approved by a legitimate personemployee and it is only the payment request that is fraudulent. Push payment fraud also known as authorised push payment fraud is a fraud whereby fraudsters conduct research often including email hacking to seek to identify two companies which have a current trading relationship.

Fraudsters commit this crime by convincing a business or individual to send money for what seems like a legitimate invoice. This is basically what happens in authorized push payment fraud but there is one key difference and that is the authorization process itself. It may even come from an email address that the business or individual recognizes such as a supplier.

What is push payment fraud. Because the victim believes the fraudster to be genuine they authorise the handover of cash. The APP fraud data for the first half of 2019 shows.

An authorised push payment APP scam also known as a bank transfer scam occurs when you - knowingly or unwittingly - transfer money from your own bank account to one belonging to a scammer. APP fraud is a relatively unsophisticated deception but it is extremely effective due to the way in which it is delivered. Chances are that you or someone you know has been the target of Authorised Push Payment fraud.

The Payment Systems Regulator a subsidiary of the UKs Financial Conduct Authority launched the APP Scams Steering Group two years ago. What is Authorised Push Payment APP fraud. Upon receipt the funds are scattered to the four winds and the victim generally loses their.

In the case of APP fraud the PSP is often a bank which holds the accounts of either the victim or fraudster. The alarming statistics In 2018 alone losses due to Authorised Push Payment APP fraud totalled 3543m across an alarming 84624 cases nationally. Paying an invoice that looks exactly like one from their childs school but turns out to be.

Currently the sending PSP but not the. The panel has since introduced a voluntary code intended.

Authorised Push Payment Fraud The Liability Challenge Business Intelligence Info

Authorised Push Payment Fraud The Liability Challenge Business Intelligence Info

How Fraud Changes In The World Of Real Time Payments Fico

App Scams Payment Systems Regulator

App Scams Payment Systems Regulator

What Is Authorised Push Payment Fraud How To Protect Yourself And Your Finances

What Is Authorised Push Payment Fraud How To Protect Yourself And Your Finances

Authorised Push Payment Fraud More Than Just Confirmation Of Payee Nice Actimize

Authorised Push Payment Fraud More Than Just Confirmation Of Payee Nice Actimize

How Authorised Push Payment Fraud Works And How The Banking System Seems To Help It Diagramming Out Loud

How Authorised Push Payment Fraud Works And How The Banking System Seems To Help It Diagramming Out Loud

Authorised Push Payment Fraud Leapt 44 In Uk Analysis Bpi The Destination For Everything Process Related

Authorised Push Payment Fraud Leapt 44 In Uk Analysis Bpi The Destination For Everything Process Related

Authorised Push Payment Fraud App Fraud The Perfect Storm

Authorised Push Payment Fraud App Fraud The Perfect Storm

What Is Authorised Push Payment Fraud Fico

Authorised Push Payment App Scams Tinsleynet

Authorised Push Payment App Scams Tinsleynet

What Is Authorized Push Payment Fraud

What Is Authorized Push Payment Fraud

Payment Services Directive 2 Archives Payments Cards Mobile

Payment Services Directive 2 Archives Payments Cards Mobile

A Call For Better Push Payment Scam Prevention In Light Of Liability Shifting From Customers To Banks Clari5

A Call For Better Push Payment Scam Prevention In Light Of Liability Shifting From Customers To Banks Clari5

What Are The Plans To Tackle Authorised Push Payment Fraud Cashfloat

What Are The Plans To Tackle Authorised Push Payment Fraud Cashfloat

Comments

Post a Comment