Featured

Home Mortgage Deposit

The amount of deposit you need for your mortgage is worked out as a percentage of the value of the house youre buying. Many second home mortgages require at least a 25 deposit and you may need even more than that if your current income wont cover both mortgages at the same time.

Nonetheless youll still have to meet certain criteria.

Home mortgage deposit. Copies of receipts or contracts related to the transaction especially if you earned the money via a side gig or. No secondary debt Credit Cards good savings habits etc. It will work by offering lenders the guarantee they need to provide mortgages that cover the other 95 subject to.

Your mortgage deposit is probably what you think of as your deposit. Most deposits are between 10 per cent and 40 per cent of the property value with 20 per cent being the most common. Lenders will also factor this into their assessment which can help secure favourable deals.

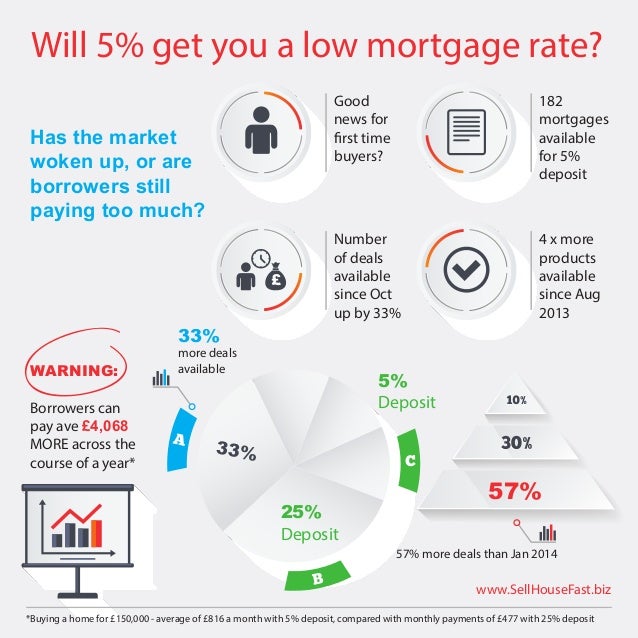

Mortgage deposit vs exchange deposit. The new scheme will tackle this by helping first-time buyers or current home owners secure a mortgage with just a 5 deposit to buy a house for up to 600000. Others will stretch to 85 under the right circumstances and a minority go 90 and up.

Find out more in our new guide to the 95 mortgage guarantee scheme. The amount you need for a deposit will depend on two main factors. We are seeing examples where people can buy existing homes with less than 10 but they must earn a significant amount and have a very clean application ie.

Its the amount youre putting alongside your mortgage to make up the total cost of your new home. 95 mortgage guarantee launches today available on high streets. Usually first home buyers with less than a 20 per cent deposit need to pay lenders mortgage insurance.

The mortgage is then based off whats left the amount youre borrowing. Deposit amount needed for a mortgage. Add a friend or family members income to your mortgage to afford more.

Mortgage guarantee scheme - The scheme opens to new 95 mortgages from April 19 2021. That means youll have a mortgage LTV between 91 and 95. You must have a deposit equivalent to between 5 and 9 of the propertys purchase price.

A mortgage deposit is an amount of money that you pay to purchase a property and is the equity you own in it with the rest of the property bought using a mortgage. Is it possible to get a second home mortgage with 90 LTV. Under the Scheme eligible first home buyers can purchase or build a new home with a deposit of as little as 5 per cent lenders criteria apply.

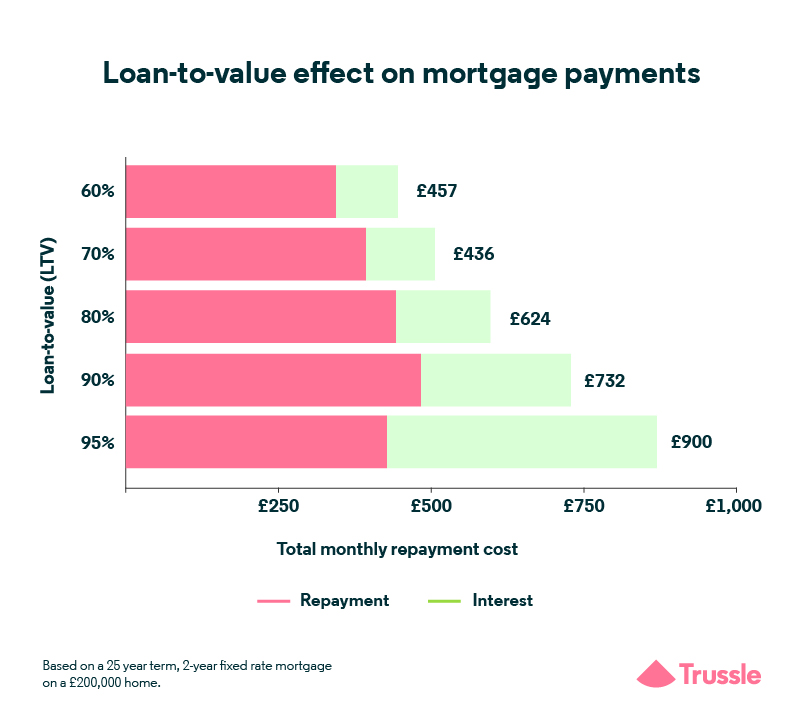

Applicants can buy their first home with a 5 deposit its eligible for homes up. If a mortgage lender is asking for proof of deposit you might need. The bigger your deposit in relation to your mortgage the lower loan-to-value ratio you have and so the better mortgage deal youre likely to get.

Youll need to pass a lenders normal mortgage affordability criteria. The scheme will run from April 2021 to December 2022 with new and existing properties priced up to 600000 all eligible. If youre thinking about getting a second property youll need a second mortgage deposit to get started.

The money sits in escrow until the down payment and. A new government-backed mortgage scheme will help first time buyers or current homeowners secure a mortgage with just a 5 deposit. The good news is because you already have a mortgage youll have experience as a homeowner.

A good faith deposit is money put in an escrow account when an offer is accepted on a home purchase. They can make regular payments or simply be on standby until you dont need their support. You must apply for a repayment mortgage.

Those who are unfamiliar with the property market may get confused when terms like. The price of your chosen property and the terms of your mortgage deal. In todays mortgage market youll need to find a deposit of at least 5-10 of the purchase price of the property in order to qualify for a mortgage.

Documentation of a loan or. The scheme will involve the government offering a guarantee to banks to encourage them to offer 95 mortgages helping people buy a home with a 5 deposit. This means that you wont be able to apply for an interest-only mortgage.

However your choice of lenders will be thin on the ground as most cap loan to value between 75 and 80. While a 100 mortgage was an option in the past these are now almost extinct and in any case can prove risky because of the. Yes its theoretically possible to get a second home mortgage with 90 LTV.

A gift letter stating that the money is a gift and you do not have to pay it back. The ideal deposit for any own-home purchase is 20 but typically the minimum required is 10 for an existing property and in some rare cases 5 for a Turn-Key build. So the largest mortgages you can get are 95 mortgages.

How To Maximise Your Mortgage Deposit Home Business Magazine

How To Maximise Your Mortgage Deposit Home Business Magazine

First Time Buyers Must Act When New Low Deposit Mortgage Schemes Are Introduced

First Time Buyers Must Act When New Low Deposit Mortgage Schemes Are Introduced

How To Save For A Mortgage Deposit Meadow Money

How To Save For A Mortgage Deposit Meadow Money

How Much Deposit You Need To Buy A House Trussle

How Much Deposit You Need To Buy A House Trussle

Deposit Calculator How Much Do I Need To Buy A House Or Home Loan

Deposit Calculator How Much Do I Need To Buy A House Or Home Loan

Can You Afford To Buy Mortgage Deposits Explained Including Family And Guarantor Help

Can You Afford To Buy Mortgage Deposits Explained Including Family And Guarantor Help

Small Mortgage Deposit Poor Mortgage Rate

Small Mortgage Deposit Poor Mortgage Rate

How Much Do I Need To Save For A House Deposit Bankrate Bankrate Uk

How Much Do I Need To Save For A House Deposit Bankrate Bankrate Uk

5 Deposit Mortgages In Short Supply

5 Deposit Mortgages In Short Supply

5 10 Deposit What Are Your Mortgage Options

5 10 Deposit What Are Your Mortgage Options

How Much Deposit Do I Need For A Mortgage

How Much Deposit Do I Need For A Mortgage

Small Deposit Mortgages Are Back Should We Be Worried Loantube

Small Deposit Mortgages Are Back Should We Be Worried Loantube

Comments

Post a Comment