Featured

- Get link

- X

- Other Apps

Bernie Sanders Tax Calculator

A stock trade of 1000 would thus incur a cost of 5. Sanderss wealth tax would begin with a 1 percent tax on net worth above 32 million for a married couple rising to 2 percent once net worth reaches 50 million.

Vox S Tax Calculator Is Wildly Misleading So We Made A Better One The Nation

Reduce the exemption to 35 million and tax the value of estates up to 10 million at a rate of 45 percent Tax estates valued between 10 million and 50 million at a rate of 50 percent Tax estates valued between 50 million and 1 billion at 55 percent.

Bernie sanders tax calculator. We estimate the budgetary and economic effects over the 10-year budget window 2021 - 2030 of Senator Bernie Sanders proposal for a graduated wealth tax starting at 1 percent tax on married couples net worth above 32 million 2 percent tax on net worth from 50 to 250 million 3 percent tax from 250 to 500 million 4 percent tax from 500 million to 1 billion 5 percent tax from 1 to 25 billion 6 percent tax from 25 to 5 billion 7 percent. Sanders plan would also hike the capital gains tax on the upper income brackets. Burman believes the tax.

For me the biggest surprise was how much more in taxes most people will pay if Bernie Sanders proposals are enacted into law. Senator Bernie Sanders Estate Tax. But the blustery and disorderly session once again failed to fully explore.

Is there a calculator that takes into account all the new taxes Bernie has proposed. Under the new Sanders plan companies with large gaps between their CEO and median worker pay would see progressively higher corporate tax rates with the most unequal companies paying five percentage points more in corporate taxes. Bernie sanders calculator We do not make any claims about the completeness reliability and accuracy of this information.

Note it will be a health care calculator since we cant do a tax calculator without his full tax plan. Bernie Sanders on Thursday proposed two new bills to hike taxes on corporations and the wealthiest Americans. Sanders plan would.

In 2016 and 2017 when Sanders also earned significant income from his books his effective tax rate was 35 percent and 30 percent respectively. In 2018 Sanders adjusted gross income was 561293. Some key details from Sanders tax returns include.

Creates many compliance costs for those administering estates An estate tax is a taxation on the transfer of wealth from a deceased person. One plan would raise the corporate tax rate back to. Bernie Sanders faced more pointed attacks last night over his potential vulnerabilities than he ever has at a debate.

Those with taxable incomes above 250000 would pay a 50 capital gains tax. Bernie Sanders proposed a more modest wealth tax as an option for financing part of his Medicare-for-all plan. Bernie Sanders Tax Calculator.

The Tax Policy Centers model does not include spending programs and thus can only show the effects of tax changes Imagine a websitemaybe one that seems to have a pronounced pro-Sanders tiltcreating a Benefits Calculator that promises to tell you how each candidates benefits plan affects you. Specifically this plan would impose tax rate increases on companies with CEO to median worker ratios above 50 to 1. If you are looking for more exact calculations go to this site.

He paid a 26 percent effective tax rate on that adjusted gross income. The main purpose of this calculator is to illustrate as simply as possible how marginal tax brackets work. Under the Sanders plan employers would pay an additional 62 percent in payroll taxes and individuals an additional 22 percent tax to finance.

Meanwhile Bernie Sanders proposes virtually the opposite. Should you need such advice consult a licensed financial or tax advisor. Bernie Sanders wants to raise corporate tax rates on companies whose CEOs earn more than 50 times the pay of a median worker.

From the calculators FAQ. Under the Sanders proposal trades would be taxed at a rate of 05 percent for stocks and 01 percent for bonds. And we might see other 2020 candidates propose wealth taxes.

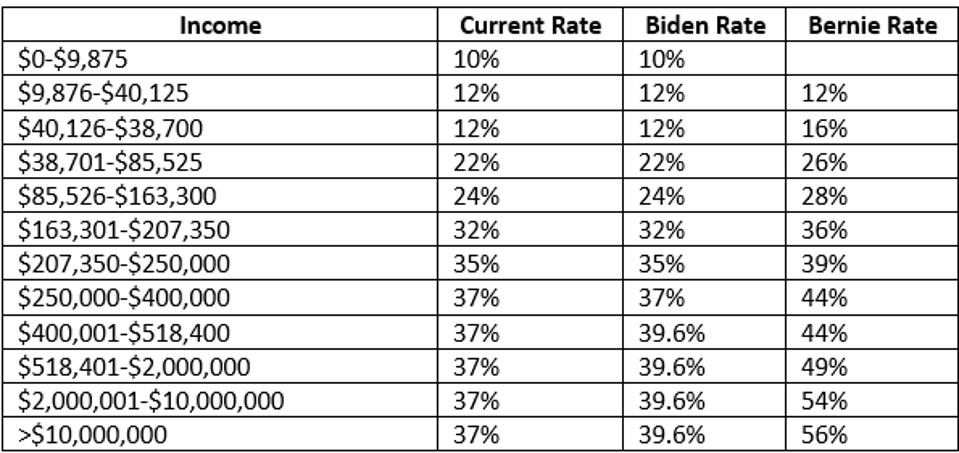

Senator Bernie Sanders introduced the For the 998 Act in 2019 a bill which would expand the federal estate tax and which he still champions in his presidential campaignSenators Elizabeth Warren and Michael Bennet have also proposed estate tax reforms but do not provide enough detail to perform a full analysis1. Tax increases on everyone with hikes on the wealthy especially while adding comprehensive government programs. Bernies tax brackets are extrapolated from preliminary numbers released on his senategov website.

In 2017 Sen.

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_asset/file/6461621/graphic.0.png) Study Most Taxpayers Would Save A Lot Of Money Under President Sanders Vox

Study Most Taxpayers Would Save A Lot Of Money Under President Sanders Vox

Did Sanders Propose Raising Taxes To 52 On Incomes Over 29 000 Snopes Com

Did Sanders Propose Raising Taxes To 52 On Incomes Over 29 000 Snopes Com

Politifact Viral Post Criticizes Bernie Sanders Math On Health Care Taxes It S Wrong

Politifact Viral Post Criticizes Bernie Sanders Math On Health Care Taxes It S Wrong

Here S What The Tax Code Would Look Like If Bernie Sanders Got Everything He Wanted Vox

Here S What The Tax Code Would Look Like If Bernie Sanders Got Everything He Wanted Vox

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

/cdn.vox-cdn.com/uploads/chorus_asset/file/5925467/capital_gains2.jpg) Here S What The Tax Code Would Look Like If Bernie Sanders Got Everything He Wanted Vox

Here S What The Tax Code Would Look Like If Bernie Sanders Got Everything He Wanted Vox

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

This Simple Calculator Tells You How Each Presidential Candidate S Tax Plan Affects You Vox

This Simple Calculator Tells You How Each Presidential Candidate S Tax Plan Affects You Vox

The Sanders Tax Plan Would Make The U S Tax Rate On Capital Gains The Highest In The Developed World Tax Foundation

The Sanders Tax Plan Would Make The U S Tax Rate On Capital Gains The Highest In The Developed World Tax Foundation

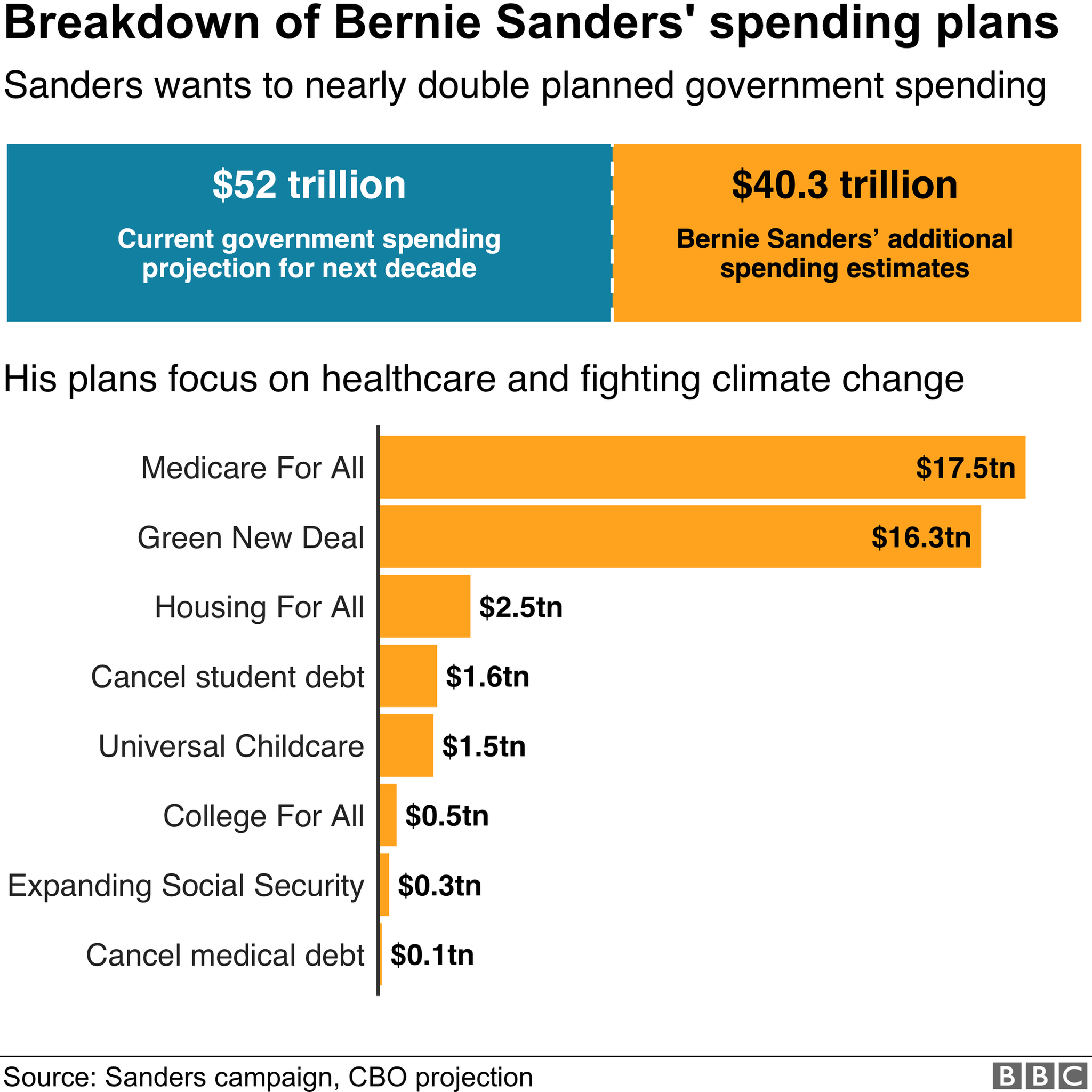

Bernie Sanders How Much Would His Spending Plans Cost Bbc News

Bernie Sanders How Much Would His Spending Plans Cost Bbc News

.png) How Danish Is Bernie Sanders S Tax Plan Tax Foundation

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

Adding Up Senator Sanders S Campaign Proposals So Far Committee For A Responsible Federal Budget

Adding Up Senator Sanders S Campaign Proposals So Far Committee For A Responsible Federal Budget

Comments

Post a Comment